While lawmakers are legally allowed to apply for and receive loans, the report has raised questions about possible conflicts of interest and a lack of transparency.

At least four members of Congress have benefited in some way from the small business relief program they created to help business owners during the coronavirus pandemic, Politico reported Tuesday.

The bipartisan group of lawmakers includes Republican Reps. Roger Williams of Texas, a wealthy owner of car dealerships, and Vicky Hartzler of Missouri, whose family owns farms and equipment suppliers in the Midwest. On the Democratic side of the aisle, Reps. Susie Lee of Nevada and Debbie Mucarsel Powell of Florida had family members benefit from the program. Lee’s husband is the CEO of a regional casino developer that received a loan, while Powell’s husband is an executive at a restaurant chain that received a loan but later returned it.

Aides and other members of Congress also told Politico that there are likely other lawmakers with ties to beneficiaries of the $659 billion Paycheck Protection Program, but the federal government is refusing to provide details about the list of recipients, leaving it up to business owners to share that information.

Democrats have sought to publish the list for transparency’s sake, but Republicans, including Williams and Harztler, voted against a bill requiring disclosure of any company that received PPP loans of over $2 million. Lee and Powell voted for the bill. House Democrats have a majority, but because the legislation was introduced under special rules requiring a supermajority vote, it failed.

“This is the largest distributor of taxpayer money in human history, and we need to ensure taxpayers know where it’s going,” the sponsor of that bill, Rep. Dean Phillips of Minnesota told Politico.

The PPP was passed with the aim of helping some of America’s 30 million small business owners weather the coronavirus pandemic by providing forgivable loans of up to $10 million for operating expenses. The program, offered through the Small Business Administration and its partner banks, has been under intense scrutiny, as banks initially prioritized wealthier clients and provided many loans to large corporations and Republican donors, while many Black and Brown small business owners were left out. The revelation that members of Congress benefited from loans is likely to fuel further controversy.

All four lawmakers said the loans were acquired through proper channels. Full House Resorts, of which Lee’s husband is the president and CEO, received $5.6 million, according to filings with the Securities and Exchange Commission. Fiesta Restaurant Group, where Mucarsel Powell’s husband works as an executive, received $15 million before returning the loan in full.

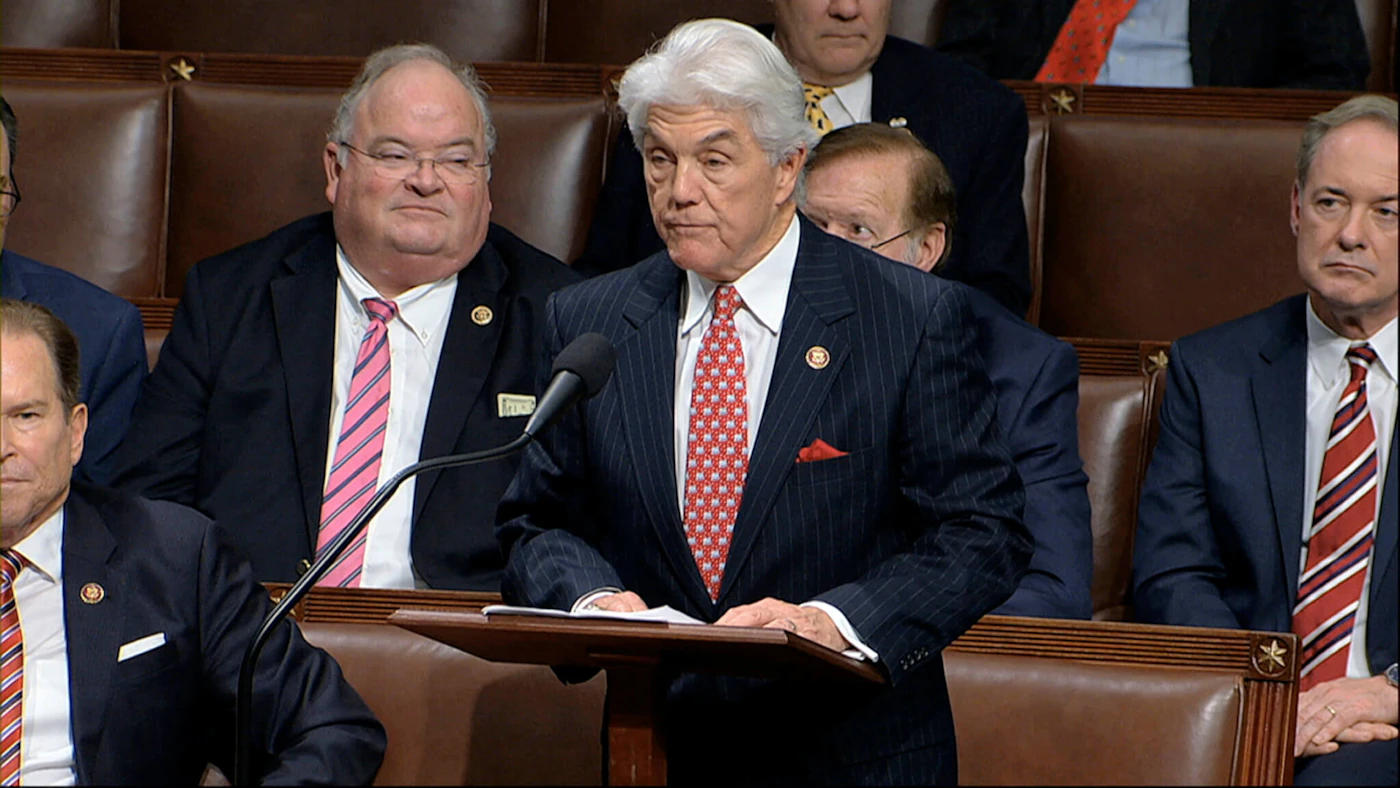

The Republican lawmakers declined to provide Politico with details of their loans. Much of the new backlash has focused around Williams, one of the wealthiest members of Congress who had a net worth of over $27 million in 2018. He received a loan for an undisclosed amount for his Dodge/Jeep dealership in Weatherford, Texas, where his wife is also employed.

RELATED: Big Companies — Not Small Businesses — Made Bank Off of Trump’s Paycheck Protection Program

While lawmakers are legally allowed to apply for and receive loans, the report has raised questions about possible conflicts of interest and a lack of transparency. The Treasury Department and SBA have refused to disclose recipients even after initially promising to do so.

Treasury Secretary Steven Mnuchin promised that the Trump administration would aim for “full transparency” in releasing information about PPP recipients. “I think that the American public deserves to know what’s going on, given the amount of money that we’ll be putting out,” he told CNBC on April 8.

Last week, Mnuchin reversed his earlier position while testifying before the Senate Small Business Committee. He said the Trump administration would not reveal the companies that receive PPP funds.

On Sunday, White House economic adviser Larry Kudlow also told CNN the Trump administration had never promised to share the names of PPP recipients. “Insofar as naming each and every company, I don’t think that promise was ever made,” he said on CNN’s State of the Union. “And I don’t think it’s necessary.” Addressing Mnuchin’s earlier statements, Kudlow said: “I think when Secretary Mnuchin talked about transparency, he talked about the transparency of the process of making the evaluation for the loan and then the distribution of the loan.”

This turnabout has only increased scrutiny of the PPP, which was already mired in controversy after banks initially prioritized wealthier clients and provided many loans to large corporations and Republican donors, while many many Black and Brown small business owners were left out.

RELATED: ‘We Didn’t Receive Anything’: How Michigan’s Black Businesses Got Left Out of PPP

Like Phillips, Democratic Rep. Katie Porter of California also introduced a bill in May to improve transparency. Porter’s bill would require all loans under the PPP to be made public. She specifically name dropped Rep. Williams in the press release introducing her legislation, which she said was “the only way to quickly and fairly show who is using this program to line their pockets.”

“If you’re a multimillionaire taking taxpayer money in the middle of the biggest unemployment since the Great Depression, get ready to explain that decision to the American people,” Porter said in a statement. “If you’re willing to take public money, you should be willing to face public scrutiny. That’s what government accountability is all about.”

Porter’s bill has yet to receive a vote in the House. Republicans blocked Phillips’ bill after raising concerns that the measure could “name and shame” recipients of PPP loans or lead to the sharing of confidential payroll information.

Phillips told Politico he’s working to bring the bill to the floor again for a simple majority vote and was open to making changes to protect payroll data, but said transparency was essential. “My simple, but very strong belief is that taxpayer dollars — when distributed by Congress and the executive branch of our government — should be transparent and subject to accountability,” Phillips said. “Plain and simple.”

That sort of pressure may be working. Treasury Secretary Steven Mnuchin said Monday he would speak with lawmakers about how to provide oversight of the PPP.

Sen. Marco Rubio (R-Fla), who chairs the Senate Small Business Committee, said Friday he would “work closely with SBA and Treasury to ensure enough data is disclosed about the program to determine its effectiveness, and ensure there is adequate transparency without compromising borrowers’ proprietary information.”

It remains to be seen if such efforts would specifically require transparency from members of Congress. There are currently no disclosure rules for members of Congress when it comes to the PPP program.